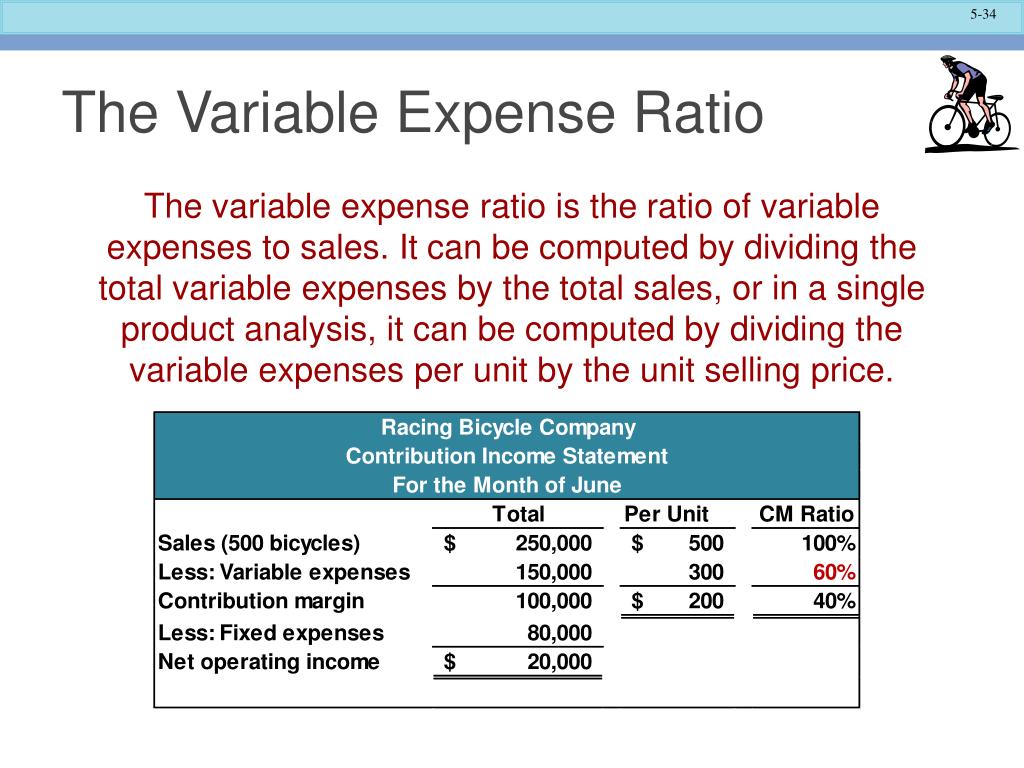

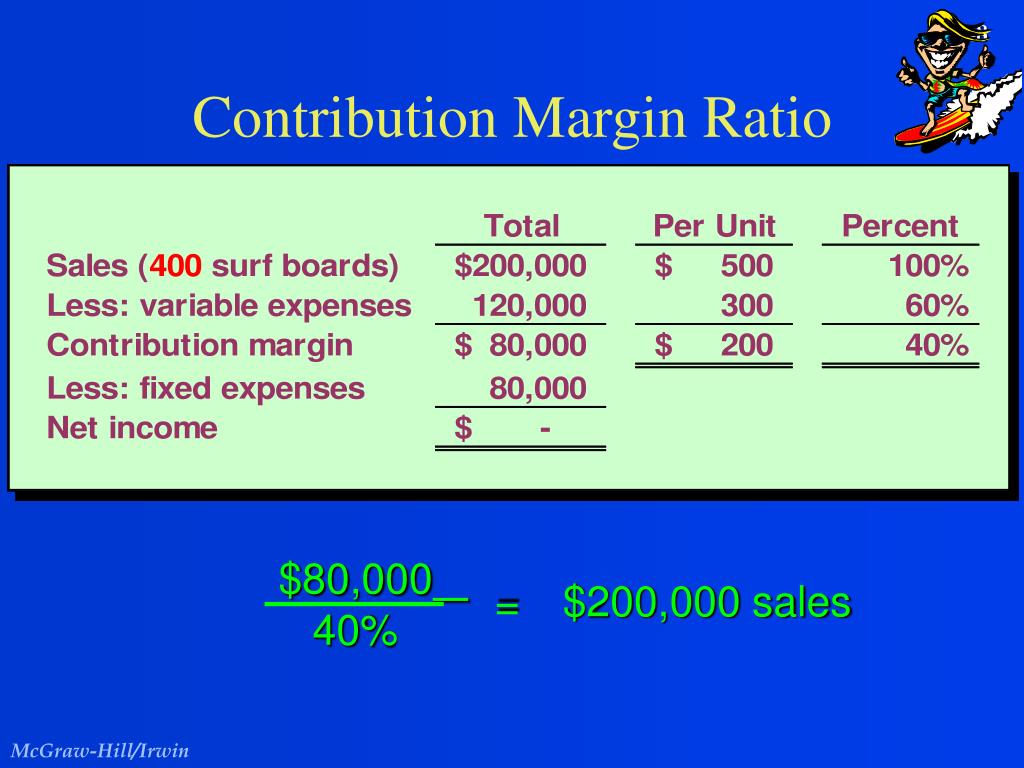

The contribution margin per unit is the rupee amount contributed by the sale of one unit to fixed costs. Net Income = Operating Income – Taxes Contribution Margin Analysis Operating Income = Total Revenue – (Fixed Cost + Variable Cost) Cost Volume Profit Analysis is a part of the variable costing technique, which is one of the most useful techniques used by the management in decision making.Ĭost Volume Profit Analysis is concerned with the effects on net operating income. It helps in studying “the effects on future profits with change in fixed cost, variable cost, sale price, quantity, and mix”. When volume changes cost and profit change.Ĭost Volume Profit Analysis is a technique used by management for profit planning. For example, when the cost of production changes the volume of sales will be affected and profit will also change.

When there is a change in aby one factor the other factors are also changed. Under Cost Volume Profit Analysis, we try to study the effect of change in one factor on the other factors.

It helps to understand the interrelationship between cost, volume, and profit in an organization. Cost Volume Profit Analysis is a method of accounting that looks at the impact that varying levels of costs and volume have on the operating profit of a business.

0 kommentar(er)

0 kommentar(er)